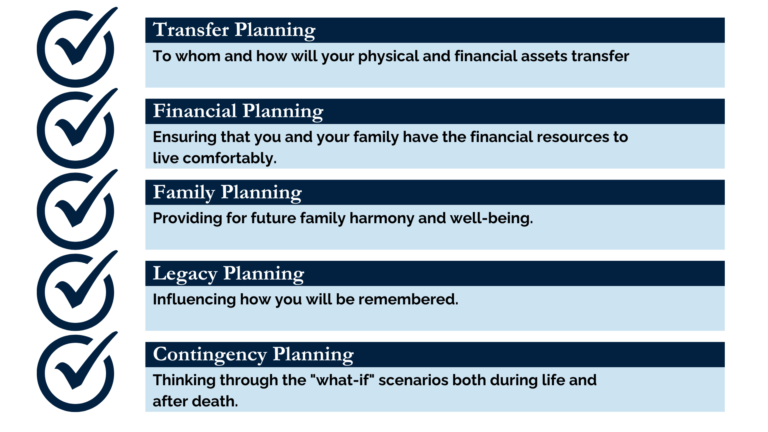

Estate planning is the process of planning for the efficient and effective transfer of your assets after death, giving consideration to the challenges of property, tax, and probate laws.

An estate plan refers to both the plan of action in event of your death or incapacity and the set of legal documents involved to carry out your intent.

Basic estate planning documents in Hawaii include a Will, Trust, Durable Power of Attorney, and Advance Health-Care Directive.

A Will is a formal legal document that provides instructions on how you would like your assets to be distributed upon your death.

The terms of your Will designate who will be the Personal Representative of your Estate (the person responsible for settling your Estate) and the Guardian of your minor children, if any.

Upon your death, your Will must be validated by the Probate Court and a Personal Representative must be appointed by the Court before settlement of your Estate can begin. The Probate Court process can be time-consuming and costly and is a matter of public record.

In Hawaii, in general, a valid Will is in writing, signed by the the person making the will, and witnessed by at least two individuals (generally competent to be a witness), each of who have signed the Will acknowledging the maker’s signature.

The person making the will and two witnesses must sign before a notary public. If the Will does not meet these requirements, the Will still may be found valid by the Hawaii Probate Court depending on the surrounding circumstances.

A Trust is a legal relationship that is created when:

A party (known as the “Grantor”, “Settlor” or “Trustor”),

– transfers property to a person or company (known as the “Trustee”),

– to hold the property in accordance with the provisions of a written instrument (the trust document),

– for the benefit of one or more persons or entities (the “Beneficiaries”).

Property includes both real property (such as land and buildings) and personal property (such as bank accounts, stock and bonds, and personal effects.

A Trust can be used to avoid probate, provide asset management, minimize state and federal transfer taxes, and ensure your assets are distributed at your death according to your wishes. A common form of a Trust is a revocable living trust whereby the Grantor retains the authority to make changes to the terms of the trust document during his or her lifetime.

During your lifetime, you can serve as the Trustee and remain in control of the Trust assets. Upon your incapacity, your Successor Trustee will manage your assets for your benefit. Upon your death, your Successor Trustee will ensure all last bills are paid, taxes are filed and paid, and assets are distributed as directed in the trust document.

Having a Trust allows for a seamless transition upon your incapacity and/or death

A Durable Power of Attorney is a legal instrument that appoints an agent (also called an attorney-in-fact) to act on your behalf with regards to your financial matters.

An agent can be appointed for a very specific purpose (i.e., signing closing documents for real estate sale) or for more general purposes.

Your agent will have authority to manage non-trust assets while you are alive, but does not have authority to manage your Trust assets. The Power of Attorney terminates at death.

The Advance Health-Care Directive allows you to give instructions about your own health care, to name someone else to make health-care decisions for you, either immediately or only if you are unable to do so yourself, to designate your primary physician (optional), and whether you are a an organ donor (optional).

This form does not act as a Do Not Resuscitate, but instead informs the doctors of your end of life decisions such as life-sustaining or life-prolonging treatments and who you choose to advocate on your behalf if you are unable to do so on your own.

Choices are provided for you to express your wishes regarding the provision, withholding or withdrawal of treatment to keep you alive, including the provision of artificial nutrition and hydration, as well as the provision of pain relief medication.